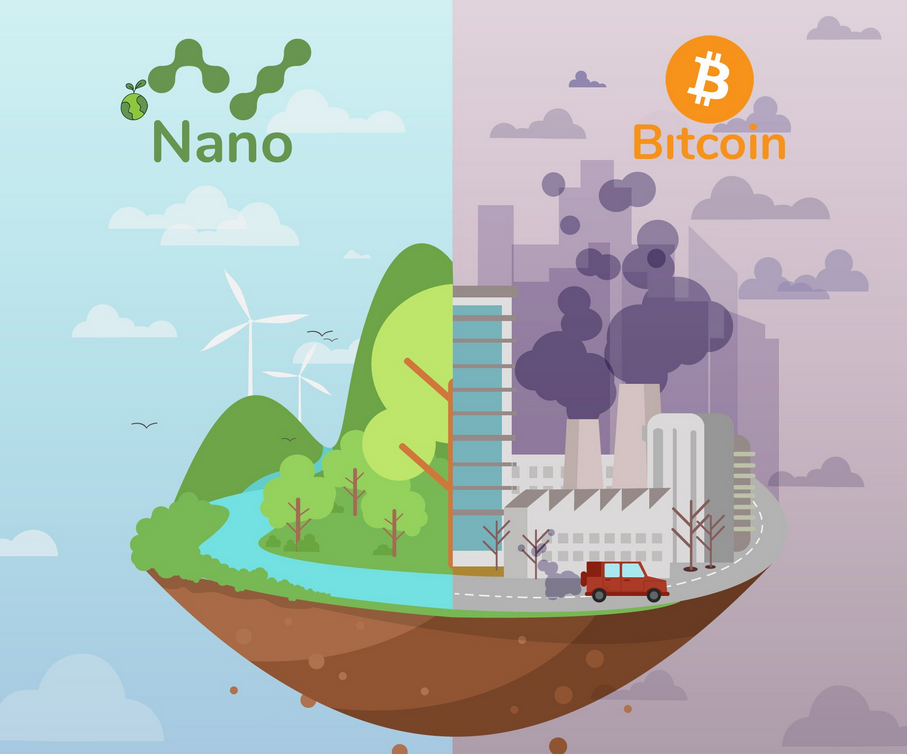

Bitcoin Vs Nano

A cryptocurrency comparison!

Introduction

More and more people have been learning about cryptocurrency. The amount of cryptocurrency users has grown exponentially over the last ten years (Statista Link). Most people introduced to cryptocurrency, have heard about Bitcoin. It is the number one cryptocurrency after all.

As of writing this article, Bitcoin’s market cap is over a trillion USD. Bitcoin is a very useful asset and store of value. Unfortunately, it has some critical flaws built into the protocol. In this article I will compare Bitcoin to another cryptocurrency called “Nano”.

Nano has the exact same goals as Bitcoin. They both aim to be a peer-to-peer digital currency and a transfer/store of value. Although the goal is the same, these currencies have very different approaches to solving the issues. Lets first discuss what these currencies have in common, then we will discuss all the differences.

Similarities

Bitcoin and Nano are very barebone protocols. In other cryptocurrency projects a lot of the networks implement things. Other networks allow for things like tokenization, smart contracts, and on-chain development. Bitcoin and Nano do not allow for any of these services. This is because they are simply a peer-to-peer transfer of value. Nothing more, nothing less. This is about where the similarities end between the two networks.

Fees

The fees are created by people wanting to interact with the network. They will pay a fee to the miners and the higher the fee the user provides, the better chance their transaction will be processed. In these times, Bitcoin fees have gone as high as $50 USD (YCharts Link). This fee is the same whether you are trying to send $10 or $10,000,000. Paying fees to transact is the norm for most PoW and PoS networks.

Nano has zero fees to the end user. If you are a user sending a fraction of a penny, or millions of dollars, it will cost you nothing. This makes it really useful for new users to go to a faucet (Nano Faucet Link), get a small amount of Nano, and actually move it around and test the network. It will cost you nothing to get a bit of Nano in your hands and utilize it. There are small fees incurred by the node operators for upkeep of the network, but these will never be passed onto the end users.

Speed

The speed of Bitcoin is based on the block times. Bitcoin has a static block time of ~10 minutes. This means that transactions are processed in groups every ten minutes. This is only if you pay a high enough fee for your transaction to be processed in the next block. If your fee is too low, you could be waiting hours or even days for your transaction to be processed. Most exchanges require 4 or more blocks to pass to confirm your transaction before you can exchange to other coins. This is a safeguard to prevent double spends.

Unlike Bitcoin, the speed of Nano is not based on block times. Since Nano uses a DAG (Directed Acyclic Graph), each account has its own blockchain. This means that transactions can be processed asynchronously. It also allows for a larger throughput of transactions with lower transaction times. The average time for transactions to be confirmed on the Nano network is roughly 0.2-0.5 seconds. Some exchanges will take longer to process transactions but from wallet to wallet, Nano will always have sub-second transactions.

Energy Usage

The energy used in the Bitcoin network is compared to the usage of full countries (BBC Link). This is because the network is secured using proof-of-work. This means a lot of heavy-duty computers are processing these transactions and powerful computers require a lot of electricity to run.

There is very little energy consumed by the Nano network. Since it is a proof-of-stake currency, the network does not require extremely powerful computers to process transactions. The math was done on how much energy a Bitcoin transaction uses versus a Nano transaction. Based on the energy usages, you could have roughly 6,000,000 Nano transaction with the same energy costs as a single Bitcoin transaction. (Reddit Link).

Consensus Method (PoW vs DPoS)

The two cryptocurrencies use different consensus methods. Bitcoin utilizes Proof-of-Work (PoW). PoW means that miners are used to the secure the network. The simplest way of explaining mining is that the Bitcoin miners have large computers attempting to solve a very complex puzzle. This can be done solo or in a pool with other users to combine their computer power for a better chance at solving the puzzle.

The miner (or mining pool) that completes that puzzle first, wins the block. Winning the block means that you get both the transaction fees paid for that block plus the block reward. The block reward started at 50 Bitcoin per block at its conception, and it gets cut in half every four years. This process is known as the “halving” and has happened three times since Bitcoin’s creation. The current block reward is 6.25 Bitcoin.

This method of consensus has been proven to be well secured. The more users that adopt the network, the more you have people mining the network, the less chance you have of a bad actor attacking the network. The problem with this method is that it uses a lot of resources. We will talk later about how much energy Bitcoin really uses.

Nano uses Delegated-Proof-of-Stake (DPoS). DPoS is a fork of the standard Proof-of-State concept. The only difference between the two are that in standard PoS, each user votes with the weight of the amount of coins they hold. DPoS does not let individuals vote, they delegate their voting weight to a larger party to vote on their behalf. A user can change who they are delegating their coins to at any point.

Nano allows up to 1000 principle representatives. To become a principle representative, you require at least 0.1% of all the voting weight. Currently there are 115 principle representatives (Nano Charts Link). This number is constantly changing as new representatives become available and as user change their delegated weight to different representatives.

Decentralization

Decentralization can be measured by two different metrics. It can be measure by how spread out the coins are and how spread out the miners/stakers are.

Measuring how spread out the coins is the same for both Bitcoin and Nano. Both of these blockchains are public and you can see which wallets hold how many coins. You probably would not know which entities are behind the wallet, or how many separate wallets the entity holds, but you can use this as a gauge of how spread out the coins are. The largest Bitcoin wallets can be found on Bit Info Charts (Bit Info Charts Link). The largest Nano wallets can be found on the Nano Faucet’s rich list (Nano Faucet Rich List Link). As you can see with Bitcoin and Nano, the largest wallets are held by exchanges and large players in the crypto world. These exchanges are holding their own coins but also the coins of their users.

The next measure of decentralization is how spread out the miners/stakers are. These are the groups that decide the fate of the network. If you ever had a malicious party gain 51% of the Bitcoin mining hash or 51% of the delegated votes, you would have a network attack that can disrupt the ledger and change who holds how much of the coins. This is considered one of the deadliest attacks that a cryptocurrency can face. The way you can measure this is by the “Nakamoto Coefficient”. This is asking how many groups of miners/stakers would it take to control 51% of the network and leave it open to attacks.

The current Bitcoin Nakamoto Coefficient is 4. Those top four miners are Ant Pool, F2Pool, Binance Pool, and Poolin. Together they hold about 58% of the current Bitcoin hash rates (BTC Link). These groups are mining pools which include both the company’s Bitcoin miners, as well as smaller users pooling in their hash rates.

The current Nano Nakamoto Coefficient is 5. Those top five principle representatives are currently 465 Digital Investments, Nano Foundation, Kraken, Binance, and BBedward. Together they hold about 52% of all the staked Nano (Nano Charts Link). These groups do not own all the Nano they are staking. The users delegate their Nano to these representatives to vote on their behalf. Should a user ever disagree with the actions of their representative, they can instantly change who they are delegating to.

Conclusion

Bitcoin and Nano both serve their own purpose in the cryptocurrency sector. Bitcoin is the original crypto and is still #1 for a reason. I think that Nano is a newer technology that was designed around day-to-day payments and has the proper scaling solutions implemented. This is where I believe the two currencies will be separated.

think that Bitcoin is slowly moving away from the ideas of “digital cash” and moving more into a “digital gold” standard. This is because of the slow transaction times and high fees. People will still use Bitcoin because it has been established over the last 10+ years. It has built an ecosystem of users, developers, and businesses that utilize the technology. I can see Bitcoin being used as a store of value and existing for large purchases and transactions. It unfortunately cannot scale and will never be used as a daily currency to buy a cup of coffee for example.

Nano has the speed and the non-existent fees to make it a world-wide currency. It has the ability to scale as more users and groups start adopting it. The protocol is already extremely well design and laid out. The only thing that Bitcoin currently has over Nano is the level of adoption it has received. As Nano continues to grow and evolve, so does its level of adoption. It is still a long way out from over taking Bitcoin, but it is definitely on the right track!